Hempel wins round in legal battle

Published 5:25 pm Tuesday, October 2, 2012

A Buchanan cab driver seriously injured in a Niles Charter Township crash almost two years ago won a battle in Berrien County Trial Court Monday, but the war against insurance goliahs slogs on.

Philip Hempel is being treated shabbily by the insurance industry, according to his attorney, Michael Marrs of Conybeare Law Office in St. Joseph.

“He’s not at fault in any regard,” said Marrs, explaining the insurance carriers refuse to pay his medical bills.

Judge John Donahue denied AAA’s motion for summary disposition, which would have excused the company as a defendant in a civil case. Donahue ruled AAA’s obligation to pay Hempel’s more than $500,000 in expenses continues.

Under Michigan no-fault insurance laws, AAA had been assigned Hempel’s claims while other companies disputed his coverage and payment responsibility.

Michigan established the Assigned Claims Plan in 1973 to provide financial help to people injured in an uninsured motor vehicle accident who have no insurance coverage of their own. The Department of State administers the plan under authority of the No-Fault Insurance Law.

Marrs argues legal maneuvering and failure of AAA to step up and pay conflicts with the intent of state law, since money paid out as assigned claim carrier, including attorney fees, would eventually be repaid by the responsible insurance company.

Chief Judge Alfred Butzbaugh found in April that First Chicago Insurance Co. is responsible for primary benefits. The company is appealing.

First Chicago insured the cab Hempel drove as an independent contractor for American Transportation on Time, South Bend. The taxi was registered in Indiana.

Hempel, 62 at the time of the Oct. 11, 2010, crash, on South 11th Street was a licensed driver with his own Michigan no-fault insurance policy with Farm Bureau Insurance Co., which denied his claim.

A car driven by Justine Nsumba, 21, of Niles, turned into Hempel’s path and was ticketed for failing to yield the right-of-way.

Hempel’s extensive injuries, for which he still needs knee-replacement surgery, broke the femur in his right leg and his wrist and ribs. He spent eight weeks in the hospital, has undergone extensive rehabilitation therapy and still uses a walker.

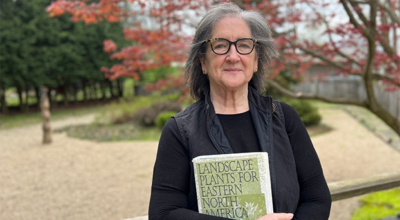

His wife, Kathie, said Monday they cannot get additional treatment until outstanding bills are paid. They have a beekeeping business and she is a freelance writer.

“It’s been a roller coaster,” she said. “It takes a toll on the entire family. If Michigan doesn’t have to step into the breach for something like this, when does it? This is exactly the kind of case Michigan no-fault law was supposed to abate.”

“They’re nice, wonderful people, and they’re being gamed by these insurance carriers,” Marrs said.

Farm Bureau’s position is Hempel was the legal owner of the cab because he drove it at least 30 days a year and was required to have it licensed, registered and insured.

“The ownership definition is too general, in my opinion,” Marrs said.

The cab company owned and registered the taxi. With no “proprietary interest” in the vehicle, Hempel could not register the car or buy Michigan no-fault insurance for it — just haul passengers. Marrs compares the situation to UPS or FedEx drivers whose duties cross the state line in trucks they do not personally own.