Niles nonprofit hosts first of four financial literacy workshops

Published 12:01 pm Thursday, January 27, 2022

|

Getting your Trinity Audio player ready...

|

NILES — One area organization has taken on the responsibility of educating Niles community members on the finances impact their lives.

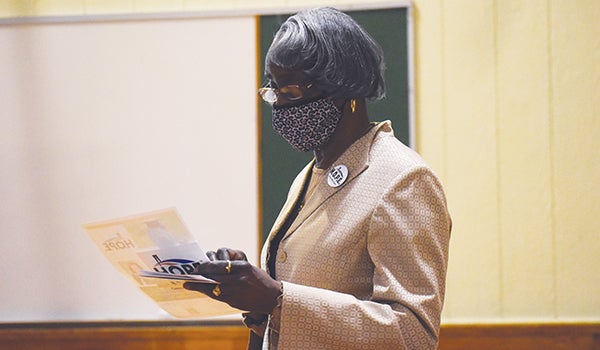

Wednesday, Helping Our People Evolve, a Niles-based nonprofit known as HOPE, hosted the first in a series of financial literacy workshops hosted at Niles Cedar Lane, 1 Tyler St. Hosted by financial coach Paulette Johnson, the workshops aim to teach community members the importance of budgeting, goal setting and how behaviors affect finances. The meetings will be hosted at 6 p.m. on the fourth Wednesday of each month, and will be available in person or virtually through the Hope for Niles YouTube channel or the Helping Our People Evolve — Hope Facebook page.

Hope President Beverly Woodson said the workshops fit in with the nonprofit’s mission of creating an inclusive community that advances in education, spirituality and civic affairs.

“We think it is important for people to know more about finances and credit,” she said. “You can’t do anything without good credit. … This is for the entire community.”

During Wednesday’s first session, Johnson, who founded Lifestyle Financial Coaching in 2017, focused on why “money matters” and the importance of taking a look into personal finances.

“We are focusing on matters of the mind, some behaviors that sabotage finances and building wealth,” Johnson said. “Mainly tonight, we are going to talk about money matters and the behaviors we develop from our early childhood today.”

During the session, Johnson asked the audience to understand the ways their spending habits are affecting their finances, so that they can get those habits under control and work toward achieving financial freedom. She also encouraged those watching to set up separate savings accounts to begin their financial journey.

She offered the following steps to financial freedom:

- Maintain a serious commitment to your finances

- Assess your financial situation

- Set smart goals

- Create a budget

- Establish an emergency fund

- Pay down debt

- Perform periodic financial checkups

- Save for retirement

“Be wise with your money,” Johnson said. “Always strive to improve and educate yourself and to learn more, because things can always be better.”

Future sessions in the series will include budgeting and setting goals, eliminating debt, and how to build and improving credit.

Both Woodson and Johnson said they would encourage any community to participate in the remaining sessions.

“In these workshops, I’m going to challenge you to look at how you spend your money,” Johnson said. “But it’s for the betterment of everyone.”